Борлуулалтын алба

Утас: (976) 7011 3808

Факс:

Имэйл: sales@sbl.mn

Үйл ажиллагааны алба

Утас: (976) 7011 3802

Факс:

Имэйл: info@sbl.mn

Ирсэн / Ачигдсан

XG: 2017.02.01 / XG: 2017.02.01

Ирсэн / Гарсан

2017.02.01 / 2017.02.01

Хүрсэн / Хүрэх газар

2017.02.01 / 2017.02.01

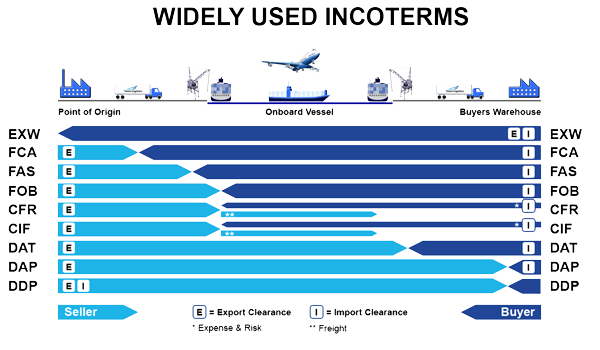

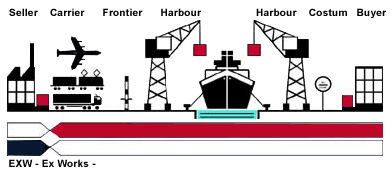

EXW: EX-WORKS

The seller, or exporter, makes the goods available to the buyer, or importer at the seller’s premises. The buyer is responsible for all transportation costs, duties, and insurance, and accepts risk of loss of goods immediately after the goods are purchased and placed outside the factory door. The Ex-Works price does not include loading goods onto a truck or vessel, and no allowance is made for clearing customs. If FOB is the customs valuation basis of the goods in the country of destination, the transportation and insurance costs from the seller’s premises to the port of export must be added to the Ex-Works price.

Under EXW, sellers minimize their risk by making the goods available at their factory or place of business.

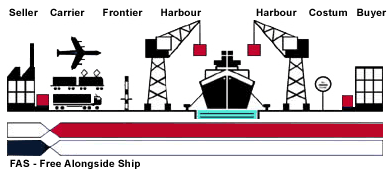

FAS: FREE ALONGSIDE SHIP

Sellers transport the goods from their place of business, clear the goods for export, and place them alongside the vessel at the port of export, where the risk of loss shifts to the buyer. The buyer is responsible for loading the goods onto the vessel, unless specified otherwise, and for paying all costs involved in shipping goods to the final destination.

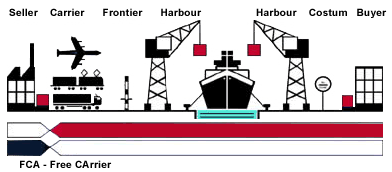

FCA: FREE CARRIER (named place)

The seller, or exporter, clears the goods for export and delivers them to the carrier and place specified by the buyer.If the place chosen is the seller’s place of business, the seller must load the goods onto the transport vehicle; otherwise, the buyer is responsible for loading the goods. The buyer assumes risk of loss from that point forward and must pay for all costs associated with transporting the goods to the final destination.

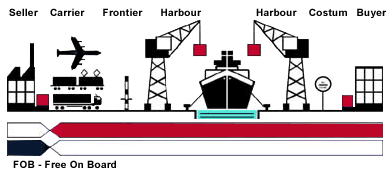

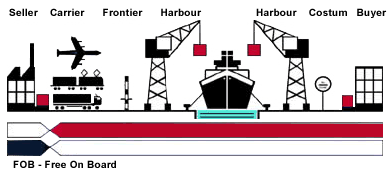

FOB: FREE ON BOARD (named port of shipment)

The seller, or exporter, is responsible for delivering the goods from its place of business and loading them onto the vessel at the port of export, as well as clearing customs in the country of export. As soon as the goods cross the “ships-rails” (the ship’s threshold) the risk of loss transfers to the buyer, or importer. The buyer must pay for all transportation and insurance costs from that point, and must clear customs in the country of import. An FOB transaction will read “FOB, port of export.” For example, assuming the port of export is Boston, an FOB transaction would read “FOB Boston.” If CIF is the customs valuation basis, international freight and insurance must be added to the FOB value.

CFR: COST AND FREIGHT (named port of destination)

The seller, or exporter, is responsible for clearing the goods for export, delivering the goods past the ships rail at the port of shipment, and paying international freight charges. The buyer assumes risk of loss once the goods cross the ship’s rail, and must purchase insurance, unload the goods, clear customs, and pay for transport to deliver the goods to their final destination.

If FOB is the customs valuation basis, the international freight costs must be deducted from the CFR price.

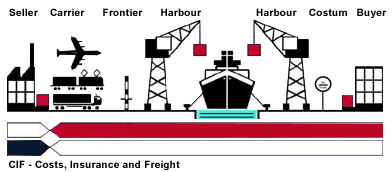

CIF: COST, INSURANCE AND FREIGHT (named port of destination)

The seller, or exporter, is responsible for delivering the goods onto the vessel of transport and clearing customs in the country of export. The exporter also is responsible for purchasing insurance, with the buyer (importer) named as the beneficiary. Risk of loss transfers to buyer as the goods cross the ship’s rail. If these goods are damaged or stolen during international transport, the buyer owns the goods and must file a claim based on insurance procured by the seller. The buyer must clear customs in the country of import and pay for all other transport and insurance in the country of import. CIF can be used as an Incoterm only when the international transport of goods is at least partially by water. If FOB is the customs valuation basis, the international insurance and freight costs must be deducted from the CIF price. A CIF transaction will read CIF, port of destination. For example, assuming that goods are exported to the Port of Los Angeles, a CIF transaction would read “CIF Los Angeles.”

CPT: CARRIAGE PAID TO (named port of destination)

The seller, or exporter, clears the goods for export, delivers them to the carrier, and is responsible for carriage costs to the named place of destination. Risk of loss transfers to the buyer once the goods are transferred to the carrier and the buyer must insure the goods from that time on. If FOB is the customs valuation basis, the international freight cost must be deducted from the CPT price.

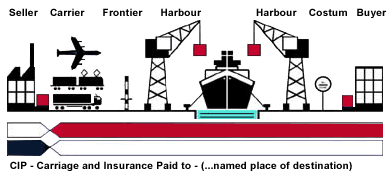

CIP: CARRIAGE AND INSURANCE PAID TO (named port of destination)

The seller transports the goods to the port of export, clears customs, and delivers them to the carrier. From that point, risk of loss shifts to the buyer. The seller is responsible for carriage and insurance costs to the named place of destination. The buyer is responsible for all costs, and bears risk of loss from that point forward. If FOB is the customs valuation basis, international freight and insurance costs need to be deducted from the CIP price.

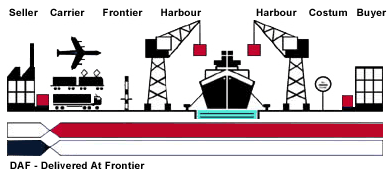

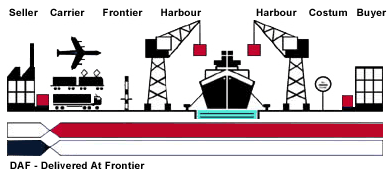

DAF: DELIVERED AT FRONTIER

The seller, or exporter, is responsible for all costs involved in delivering the goods to the named point and place at the frontier (the border between the two countries). Risk of loss transfers at the frontier. The buyer must pay the costs and bear the risk of unloading the goods, clearing customs, and transporting the goods to the final destination.

If FOB is the customs valuation basis, the international insurance and freight costs must be deducted from the DAF price.

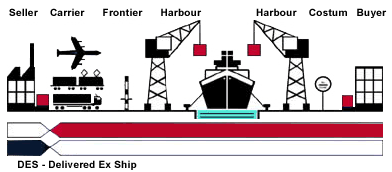

DES: DELIVERED EX-SHIP (named port of destination)

The seller, or exporter, is responsible for all costs involved in delivering the goods to a named port of destination. Upon arrival, the goods are made available to the buyer, or importer, on board the vessel. The seller is responsible for all costs and risk of loss prior to unloading at the port of destination.

The buyer, or importer, must have the goods unloaded, pay duties, clear customs and provide inland transportation and insurance to the final destination.

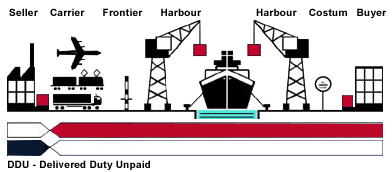

DDU: DELIVERED DUTY UNPAID (named port of destination)

The seller, or exporter, is responsible for all costs involved in delivering the goods to a named place of destination where the goods are placed at the disposal of the buyer. The buyer, or importer, assumes risk of loss at that point and must clear customs, pay duties, and provide inland transportation and insurance to the final destination.

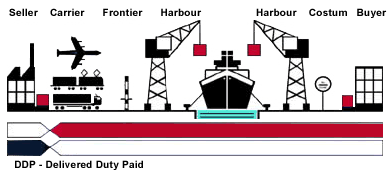

DDP: DELIVERED DUTY PAID (named port of destination)

The seller, or exporter, is responsible for all costs involved in delivering the goods to a named place of destination and for clearing customs in the country of import. Under a DDP Incoterm, the seller provides literally door-to-door delivery, including customs clearance in the port of export and the port of destination. Thus the seller bears the entire risk of loss until goods are delivered to the buyer’s premises.

A DDP transaction will read “DDP named place of destination.” For example, assuming goods imported through Baltimore are delivered to Silver Spring, the Incoterm would read “DDP, Silver Spring.” If CIF is the customs valuation basis, the costs of unloading the vessel, clearing customs, and delivery to the buyer’s premises in the country of destination—including inland insurance—must be deducted to arrive at the CIF value.

Documents required for importing special goods

1For human: Medicine, bio supplements, diagnosing device, equipment for hospital or laboratory.

Documents from Exporters

Documents from Government authorities

2 For animal: Medicine, bio supplements, diagnosing device, equipment for hospital or laboratory

Documents from Exporters

Documents from Government authorities

3 Biologically active dietary supplements

Documents from Exporters

Documents from Government authorities

4 Chemical substance

Documents from Exporters

Documents from Government authorities

5 Plants, plant products, granule, soil, seedlings

Documents from Exporters

Documents from Government authorities

6 Animals, animal products, raw materials

Documents from Exporters

Documents from Government authorities

7 Other goods

Documents from Exporters

Documents from Government authorities

Container measurement:

By DOCX file 1 - Container Measurement 1

By DOCX file 2 - Container Measurement 2

Wagon measurement:

By XLS file - Wagon measurement

HS Code – By DOCX file HS Code